To comply

Odoo Invoicing facilitates the creation of professional invoices and their customization according to your preferences.

Your invoice in one click.

Create a quote in just a few clicks, turn it into a validated invoice as soon as the client accepts it.

All the essential elements of an invoice are prepared for you: customer details, products and prices, tax rates, etc. Your invoice is - literally - just a click away.

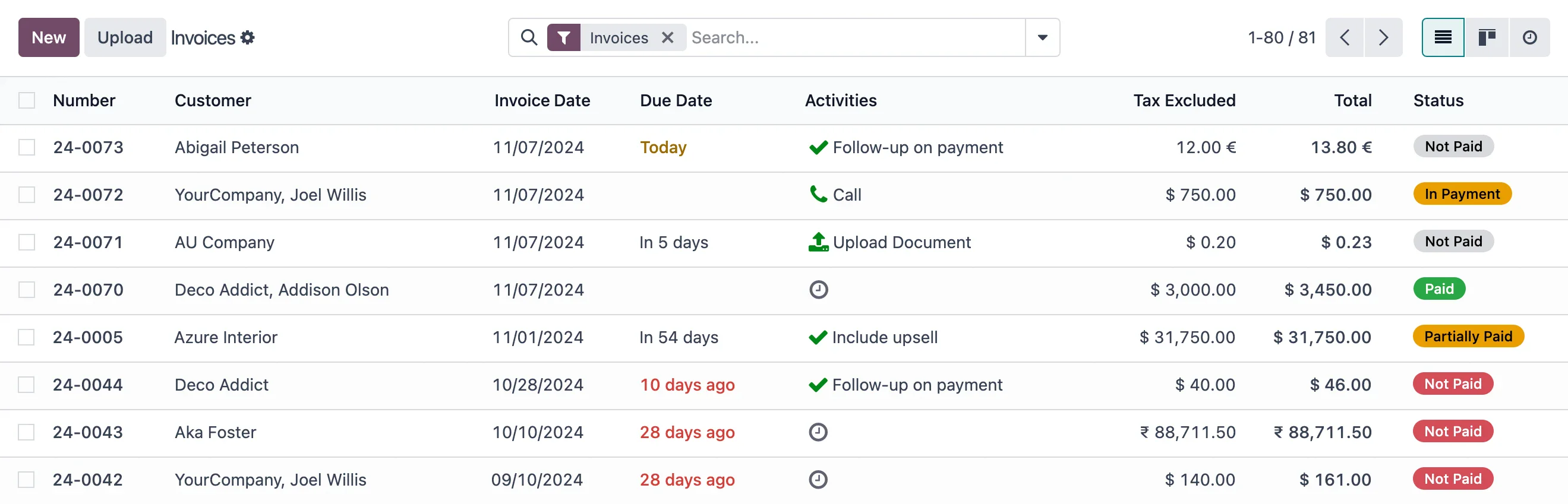

Odoo centralizes your sales and purchases. You manage your customer invoices and supplier invoices in the same module, with a clear tracking of your payments.

All your invoices

in pocket

Use the mobile app to issue invoices to your clients, update payment statuses, or even create batch payments for your supplier invoices! Anywhere, anytime.

Have your billing at your fingertips!

Download the app Odoo :

Get paid as fast as lightning.

Online payments. Redirect your customers to a client portal that will allow them to pay with their preferred online payment method !

Connect your bank

Automate follow-ups

Connect Odoo to your bank accounts to automatically reconcile your invoices and payments.

You have a clear view of your cash flow in real time.

Well-designed features.

160 countries supported

Handling of electronic invoicing for bank integrations, tax declarations, etc.

List of supported countries

Manage recurring invoices

Do you offer subscriptions? Odoo allows you to manage recurring billing automatically, with scheduled invoice sending.

Multiple currencies

Create invoices and receive payments in different currencies with automatic exchange rate updates

With Odoo, invoicing is not just about document creation: it is a comprehensive financial management tool.

Discover all the features offered by Odoo

Process refunds

Create credit notes and manage refunds.

Sales report

Dashboards, financial indicators, cash flow forecasts: everything is centralized to make better decisions.

Your invoice, your style

Customize your invoices according to your brand image.